As mentioned earlier interest on EPF is calculated monthly. The total contribution which includes cents shall be rounded to the next ringgit.

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

At the same time the employees share of minimum contribution rate has been reduced to 0 down from the previous 55.

. 08 January 2019 The minimum statutory contribution by employers to Malaysias Employees Provident Fund EPF for employees aged above 60 will be reduced to 4 per month down from the previous 6. Subseksyen 431 kadar caruman bulanan. Where the employer pays bonus to an employee who receives monthly wages of RM500000 and below and upon receiving the said bonus renders the wages received for that month to exceed RM500000 the employers contribution shall be calculated at the rate of 13 of the amount of wages for the month.

Contribution By Employer Only. So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835. AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM.

When wages exceed RM30 but not RM50. Employers contribution towards EPF 367 of Rs 50000 Rs 1835. HONoWSU6 12019Income TaxPart-I E-33306 dated 15072022.

The rate of monthly contributions specified in this Part shall apply to the following. While computing the interest the PF interest rate applicable every month is 85512 07125. The EPF interest rate for FY 2018-2019 is 865.

The contributions payable by the employer and the employee under the scheme are 12 of PF wages. By noticing this trend you have to still have a big relief that you are under the second-highest interest rate group currently as the EPF Interest Rate 2019 2020 is 85. Cara pengiraan kadar caruman kwsp socso 2019.

Mandatory Contribution Voluntary Contribution Others Home Member Contribution Last updated. Employers are not allowed to calculate the employers and employees share based on exact percentage EXCEPT for salaries that exceed RM2000000. Kwsp jadual caruman 2020 pdf kwsp kiraan kwsp mestilah mengikut.

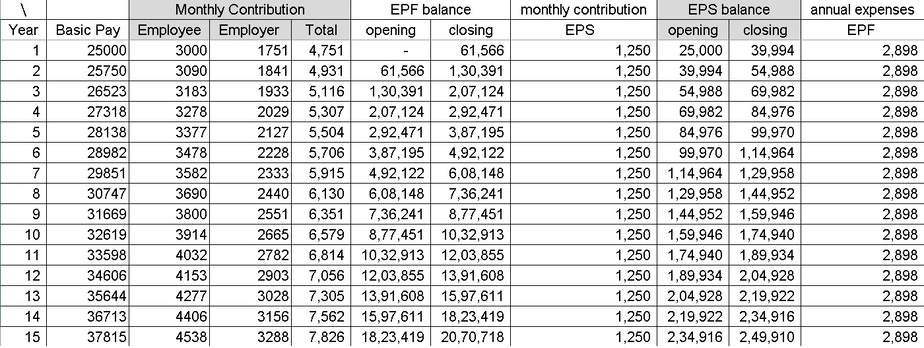

In 2019-18 members of EPFO earned an 865 of interest on their contributions towards the government saving scheme. Lets use this latest EPF rate for our example. Employees contribution towards EPF 12 of 15000 1800 Employers contribution towards EPS 833 of 15000 1250 Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550 Total EPF contribution every month 1800 550 2350 The interest rate for 2021-2022 is 810.

EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. This year this rate of 850 shall benefit 6 crore subscribers.

Corrigendum to circular dated 06042022 on Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit. Kadar caruman akta keselamatan sosial pekerja akta 4. Wages up to RM30.

Before consulting the contribution rate of the employee provident fund epf lets also see a little background epf. Employees contribution towards EPF 12 of 30000 3600 Employers contribution towards EPS subject to limit of 1250 1250 Employers contribution towards EPF 3600 1250 2350 Total EPF contribution every month 3600 2350 5950. Contribution Rate Note.

The PF interest rate for 2017-2018 is 855. Supply of Information under RTI Act 2005 to Sh. Assuming that the service was joined by the employee on 1st April 2017 the contribution in EPF account starts.

If you check out the historical EPF contribution rate it increased a lot from around 625 in 1956 to currently at 12 of BasicDA. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector. EPFO on March 4th 2021 announced the EPF rate of interest at 850 keeping it the same as of the previous year 2019-20.

Effective July 2022 salarywage August 2022 contribution month.

Epf Kwsp Dividend Rates 2019 Otosection

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

Epf Change Of Contribution Table Ideal Count Solution Facebook

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Calculator Epf Interest Pension Calculator Excel Formula Format Download

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Download Employee Provident Fund Calculator Excel Template Exceldatapro

20 Kwsp 7 Contribution Rate Png Kwspblogs

What Is The Epf Contribution Rate Table Wisdom Jobs India

Latest Provident Fund Rule Epf Contribution Must For Special Allowances Part Of Your Basic Salary Zee Business

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

How Epf Employees Provident Fund Interest Is Calculated

Epf Kwsp Dividend Rates 2019 Otosection

Download Kwsp Rate 2020 Table Background Kwspblogs

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

How To Calculate Interest On Your Epf Balance Mint

![]()

20 Kwsp 7 Contribution Rate Png Kwspblogs